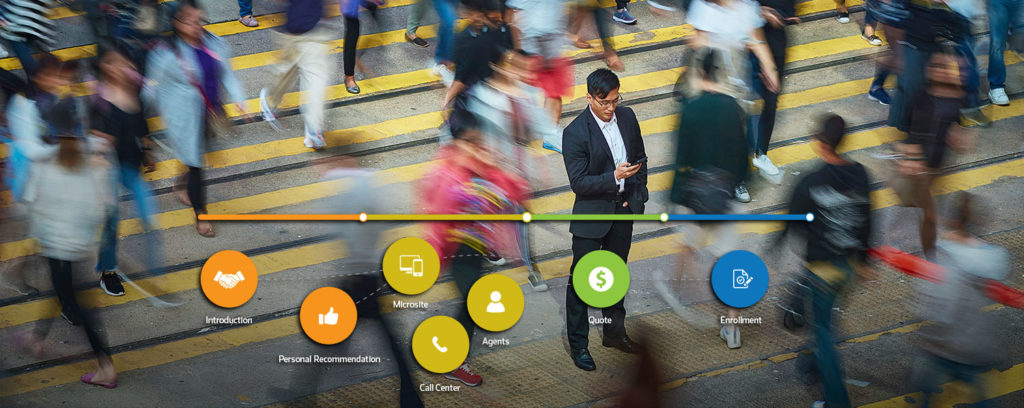

The customer journey – the process by which a customer interacts with your company to achieve an end goal – isn’t a foreign concept to the financial services industry. However, it’s certainly changed, especially when it comes to the ways in which customers shop for solutions and engage with their providers. Powerful forces such as new fintech competitors, increased online transactions, a complex regulatory environment and, of course, COVID-19 fallout have drastically impacted customers’ financial decision making.

Ultimately, the organizations that make their lives easier, better and, of course, wealthier – across the entire journey – will gain their elusive loyalty.

Focus on the holistic journey, not individual touchpoints

Staring up at a mountain of challenges, financial firms are scrambling to differentiate themselves from the competition through new products/services, specifically digital tools and platforms. The latest data proves these efforts are worthwhile for any industry player from traditional banks and insurers to wealth management firms and financial planners:

- Digital engagement has increased significantly among banking customers. Today, 50% interact with their banks through mobile apps or websites whereas only 32% did in pre-pandemic years;

- According to the World Wealth Report 2020, more than 60% of high-net-worth individuals (HNWIs) reported they were unsatisfied with their firm’s personalized information or services. They also believe that fintechs offer more personalized services/information than incumbents;

- Only 15% of customers are satisfied with their insurers’ digital experience; and

- A McKinsey survey discovered that satisfaction with insurance is 73% more likely when the customer journey works well compared to when only touchpoints do.

These stats reinforce technology’s influence on customer satisfaction as well as the overall experience. Digital tools, artificial intelligence (AI), customized omni-channel communications, etc. can pave the way for more success. With that said, the last data point indicates that financial players need to consider the bigger picture – the holistic customer journey – rather than needs at individual touchpoints.

Oftentimes, business leaders zero in on one touchpoint requiring improvement, such as better advertising for the research phase, a new, dedicated website for the consideration phase, landing pages for conversion, self-service platforms, and accessible customer support for retention, and so on. They assume that focused innovation within one phase of the journey will fuel transactional growth across the whole spectrum. However, given the fact that every customer has different needs at different times, you need to analyze the cumulative experience across multiple touchpoints and channels over time. For instance, a wealth management firm may look at each customer touchpoint, from visiting the website to calling an advisor, as its own event. However, customers often see such events as steps within a whole journey. The destination is fulfilling a need (i.e. safeguarding their family’s financial future, saving to enjoy retirement, etc). A siloed focus on individual transactions or touchpoints would cause you to miss the customer’s end goal.

Hence, building the relationship across the entire customer journey is where you need to channel your energy.

Creating data-driven customer journeys

While it’s clear that financial leaders need to investigate and observe their customer experience, it can be difficult to know where to start. A quick online search will present you with customer journey templates built for financial services organizations, but you can’t solely rely on models that lack relevant context or data. Your company and most importantly, your customers, are unique. It’s critical to go through the process yourself, using your own historical data and research.

Here are a few questions to consider:

1. Who are your customers?

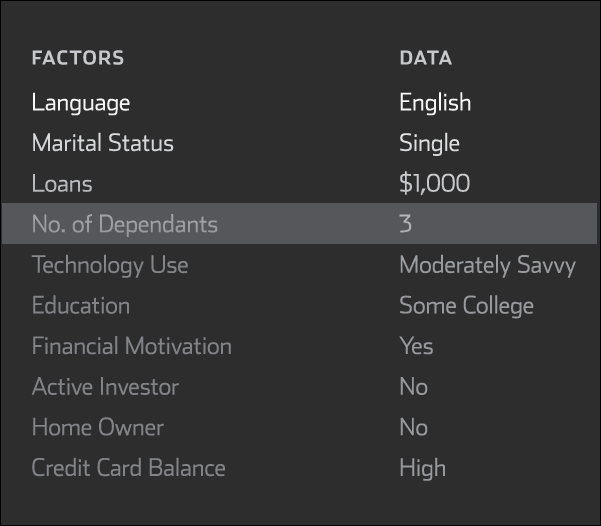

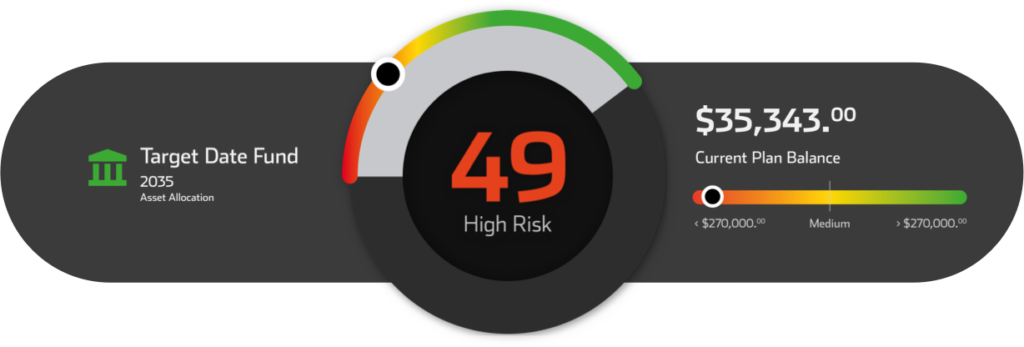

Hopefully, your CRM offers helpful analytics regarding your audience. Gender, age, occupation, location, etc. are important, but you’ll want to go beyond demographics and analyze their pain points, communications and device preferences, previous experiences and social detriments data. Ideally, your analytics platform delivers behavioral insights (i.e. recent transactions, life events or triggers, financial readiness scores, etc.) that give you a 360-degree view of your customer.

With this information, you can create customer profiles (aka personas). Maybe you’ve developed these in the past, but a lot has changed in recent years, especially following the pandemic. It’s time to update them based on present-day circumstances. O’Neil’s ONESuite CCM and CX platform delivers “live” personas that offer real-time insight into your audience based on their historical behavior and engagement.

2. What’s their current end-to-end journey?

Next, evaluate the specific steps taken when customers interact with your brand. Often, these steps are broken down into the following stages:

- Research – Customer identifies a problem or need requiring a financial service/product

- Connection & Cultivation – Customer discovers your brand (likely online) and explores if you offer the ideal solution

- Consideration – Customer evaluates multiple options before making a decision

- Acquisition / Conversion – Customer decides to enroll in your product or plan

- Onboarding – Customer connects with financial rep/advisor to understand your brand and opportunities; sets the tone for the ongoing experience

- Retention – Customer deepens his/her relationship with your brand, taking advantage of additional products/services.

- Advocacy – Customer provides positive feedback and refers your brand to family and friends.

Of course, these stages are generalized based on traditional journey templates. Your own maps may be more simple or much more detailed, depending on your typical customer experience.

3. What communications channels do they interact with?

After creating your customer journey(s), invite various stakeholders from across the organization to offer their input. Sales, marketing customer service, C-Suite, etc. can all offer additional perspectives that help you make your journey as precise as possible.

Additionally, consider what communications channels your customers interact with at each stage of the journey. Likely, each stage will include a mix of in-person and online channels: social media, online advertising, direct mail, mobile texts, website, online portals or apps, customer support, and more.

You should also question what channels customers would prefer to use at each stage. Are there ways you can make their lives and decision-making easier? For example, if your firm or bank only offers a phone hotline for customer issues, would a website chatbot improve the troubleshooting process? These considerations allow you to enhance your communications in ways that increase customer satisfaction. Remember, the journey should be all about helping them achieve their goals.

4. How can we make the experience better?

After mapping out your journey’s stages and communication channels, it’s time to create a plan that aims to fix what’s broken and upgrade what will enhance the end-to-end experience. A customer-centric approach to strategic planning and prioritizing to-do lists results in multi-layered success – increases in satisfaction, retention, advocacy, and ultimately, increased growth and revenue for your company.

Overcoming the blind spots

Oftentimes, financial institutions going through the steps listed above realize that they lack the analytics or insights needed to create highly accurate, end-to-end journeys, especially when it comes to narrowing in on customer behavior. While you may have an ocean of historical data – demographics, transaction history, etc., many CRM tools don’t always unify data from multiple sources or translate it into actionable insights.

A sophisticated CX platform supports a 360-degree view of the customer, telling you who your customers are, what they feel, how they think, and more. The ability to access this information enables marketing, sales, customer service, and other departments to make informed decisions about improving the whole experience. While deploying an advanced CX platform is undoubtedly expensive and disruptive, it’s critical for elevating every stage of the journey. Today, many financial leaders themselves are embarking on their own platform transformation customer journeys to ensure their businesses are fit for the road ahead.

Contact O’Neil

O’Neil helps a variety of financial services firms maximize their customer experience and communications management strategies. Contact us for a consultation or to preview our ONEInteractive tool.