In the rapidly evolving landscape of financial services and insurance, customer expectations are higher than ever before. Today’s customers demand personalized, relevant, and meaningful interactions. To meet these expectations and build stronger relationships with clients, financial and insurance companies are turning to data analytics and social determinants of health (SDOH) to provide more meaningful communications and better experiences. In this article, we will explore how these industries can leverage data, including SDOH, to enhance customer experiences.

The Power of Data in Financial and Insurance Services

Data has become a cornerstone of decision-making in the financial and insurance sectors. These industries have long recognized the value of data in assessing risk, managing portfolios, and detecting fraudulent activities. However, data’s potential extends far beyond these traditional uses. Financial and insurance companies can leverage data to:

- Personalize Customer Interactions: Personalization is key to engaging customers effectively. By analyzing customer data, including transaction history, browsing behavior, and communication preferences, companies can tailor their messages and offerings to individual needs. This level of personalization builds trust and fosters stronger customer loyalty.

- Predict Customer Needs: Predictive analytics can anticipate customer needs and preferences. By analyzing historical data, companies can identify patterns and trends, allowing them to proactively offer relevant services or products. For example, insurance companies can use predictive analytics to offer policy upgrades or discounts based on a customer’s changing life circumstances.

- Improve Risk Assessment: Data-driven risk assessment is fundamental in the insurance industry. Incorporating a broader set of data, including SDOH, allows insurers to better understand a policyholder’s risk profile. SDOH data, such as socioeconomic status, living conditions, and access to healthcare, can provide valuable insights into an individual’s health and potential insurance risks.

The Role of Social Determinants of Health (SDOH)

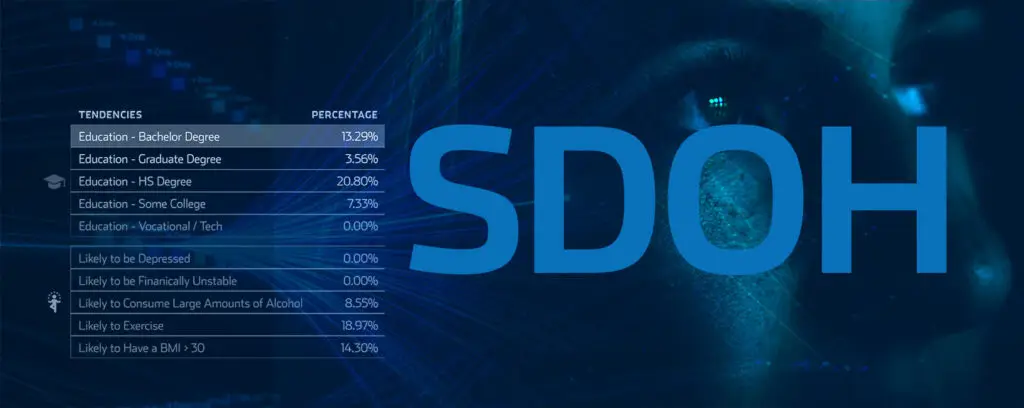

SDOH refers to the conditions in which people are born, grow, live, work, and age. These factors have a significant impact on an individual’s health and well-being and are increasingly recognized as essential in the financial and insurance industries. By incorporating SDOH data into their processes, these companies can:

- Enhance Underwriting and Pricing: Understanding SDOH can help insurance companies refine their underwriting processes and pricing models. For example, if data shows that a policyholder lives in an area with limited access to healthcare services, the insurer can offer wellness programs or discounts to encourage preventive care.

- Mitigate Risk: By identifying SDOH-related risk factors, insurers can take proactive measures to mitigate potential losses. For instance, they can provide policyholders living in high-risk areas with resources to improve their living conditions or access to specialized health services.

- Promote Health and Well-being: Financial services companies can collaborate with insurance providers to offer holistic financial planning that considers SDOH. This approach ensures that customers receive guidance on managing their finances in a way that aligns with their health and well-being goals.

Leveraging Technology and Analytics

To harness the full potential of data and SDOH, financial and insurance companies must invest in advanced technology and analytics. Here are some key steps they can take:

- Data Integration: Integrate various data sources, including SDOH data, into a centralized platform for comprehensive analysis.

- Advanced Analytics: Implement advanced analytics tools, such as machine learning and artificial intelligence, to derive actionable insights from the data.

- Data Privacy and Security: Prioritize data privacy and security to maintain customer trust and comply with regulations.

- Cross-Functional Collaboration: Foster collaboration between different departments to ensure that data-driven insights are used to inform decision-making across the organization.

How Can I Access Social Determinants of Health Data?

Through its ONEscore CCM + CX platform, O’Neil Digital Solutions offers its clients the tools and services they need to understand and enrich customer data. ONEscore is a data analytics engine that enables clients to accurately study recipient behavior in real time and properly segment their customers using 360° live personas. Through this resource, clients can access insights that drive behavioral change. To contact O’Neil Digital Solutions with questions or for a demonstration of ONEscore, click here.

Conclusion

In the ever-evolving world of financial services and insurance, leveraging data, including SDOH, is paramount to delivering more meaningful communications and better customer experiences. By personalizing interactions, predicting customer needs, improving risk assessment, and incorporating SDOH data, these industries can build stronger relationships with their clients, enhance their services, and ultimately thrive in an increasingly competitive landscape. Embracing data-driven strategies is not just a trend—it’s a necessity for future success in these sectors.